SBA Default Blog

Want to listen instead of reading? Check out my podcast. Otherwise, select a CATEGORY or click on a link below.

Dear Visitor,

Thank you for taking time out of your busy day to visit my website. I hope you find the information within the site to be informative and helpful. When I first starting writing articles about SBA default resolution, I was apprehensive about “giving away” too much free information. Why buy the cow, they say, when you can get the milk for free? I then realized that the consulting services I provide for my clients in real time goes beyond just words on a page. Once that realization set in, I have endeavored to cover every question I’ve been asked by actual and prospective clients over the years about settling commercial debt and SBA loan foreclosure conditions.

If you are considering hiring me to help you, there are some important things you should know about me:

My only area of focus is Offer In Compromise for SBA loan defaults.

I do this to ensure that I remain aware of all the current policies and changes to SBA protocol. SBA loan settlements require very specific knowledge, so simply having experience with commercial debt settlement is not enough. Keep this in mind when interviewing potential advisors.

I Pride Myself on Being Responsive and Available

During a time when you are in dire need of help, it’s my job to reduce your anxiety. While settlement is the ultimate goal, I also know that having an accessible advisor can alleviate the stress of wondering when (or if) you will get a call back. People frequently reach out to me because they can’t get their SBA attorney on the phone. I simply don’t allow things like that to happen.

When you become a client, I don’t limit my communication with you to 9-5. You’ll be able to text me or call me whenever you have a question. Sure, I take time with the family, but if you have a quick or urgent question regarding your SBA loan default, more often than not you’ll hear back from me very quickly.

I Don’t Make Empty Promises or Guarantees

These days, it seems that everyone with something to sell makes bold guarantees. But really, what does it mean for me to say that I guaranty that I will settle your debt if there are no real consequences if I don’t deliver? For that reason, I make it clear in my consulting agreement that there are no guarantees of success. Is my track record good? Yes, extremely good. Will I do everything in my power to help you? Of course. Can I 100% guaranty success? Unfortunately not, and neither can anyone else. In most cases, my fees and payment terms are better my competitors to begin with, but in the rare case when they are not lower, I will match any reasonable fee structure. If you think I’m your guy, let’s talk. I can almost always find mutually agreeable terms with borrowers who wish to hire me.

The Buck Stops With Me

Who would you rather have fighting for you: an employee of a company, or the founder and owner of the company? With me you will always get the latter. I make all the decision, produce all work products, and personally negotiate every deal. When I’m hired, I handle all aspects of your file from start to finish. Retain me, and you’ll never be passed to a junior, less experienced employee.

The Only True Insider

To my knowledge, no other SBA Workout Consultants can claim they know the SBA loan default process from the inside. I worked for banks for 11+ years, including 2 overseeing a team of workout officers that serviced a $276 Million SBA loan portfolio.

100% “Above Board”

The basis for a settlement is honesty and offering full disclosure, and I will never advocate a strategy that deviates from that premise. Schemes like selling your business to a friend, an associate, or to a new corporation (which is owned or controlled by you, a friend, or business associate) are all fraudulent. If you aren’t telling your bank the whole truth about the relationship between you and the buyer, you are probably doing something wrong.

Thanks for stopping by, and feel free to email me at Jason@jasontees.com or call me toll free at . with any questions you might have.

Sincerely,

Jason Milleisen

Founder & Owner, Distressed Loan Advisors

Seeking Answers To Your SBA Default Questions? Start Here

Do you have questions about how to handle an SBA default? This post covers it all: what the entire SBA Offer In Compromise process entails (step by step), while also answering the most common questions that people have asked me over the course of the past 9 years as an SBA default guru. I’ve settled hundreds of SBA loans, which has resulted in over $50,000,000 saved for my clients. You can see a small sample of the results I’ve achieved for my clients here. So yeah, it’s safe to say I’ve seen some stuff.

Who Wrote This Article?

Before we nerd out on SBA default, please allow me tell you who I am. You came to my site, so I’ll explain why I am an expert on this particular topic. My name is Jason Milleisen, and I am the founder and Distressed Loan Advisors. I personally handle every single client because, honestly, your Offer In Compromise is that important and I don’t trust anyone else to handle it.

I started DLA in 2009, when it was a side gig that I was running while I was a workout officer for the largest SBA lender in the US. My job was work handle a portfolio of hundreds of defaulted and delinquent SBA loans, representing several hundred millions of dollars.

In early 2011, I was so busy helping my own clients, that I quit my cushy job as a Bank VP to run DLA full time. And since then, I’ve done nothing but work on SBA loans. So that’s pitch on why I’m a big deal when it comes to the SBA Offer In Compromise. Simply put, when it comes to SBA Offer In Compromise, I don’t think anyone does it better than me . Now, let’s get to the good stuff you came here to read.

SBA Offer In Compromise 101 – An Overview

Making the decision to close your business is not easy, but often times, it is absolutely the correct thing to do. Once you make the decision to close your business, the next inevitable question is: Now what?

Close The Business or Sell The Business Assets

If you are closing your business, you are likely aware that there will be some loose ends to tie up. You need a plan to deal with those loose ends. That plan includes working with your bank to get the business closing and liquidation done. Only then can we resolve the issue of your personal guarantee.

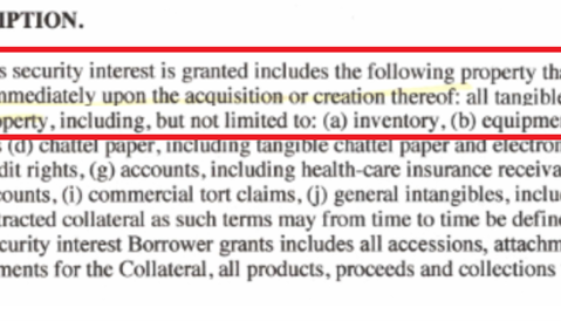

In almost all cases, the SBA loan you have is secured with the assets of your business. That can include tables, chairs, ovens, sinks, etc. Before they will entertain talk of settling your debt, your bank will first want to liquidate all the collateral. Note that the one exception is your primary residence. You need to contact your bank. Explain to them that you have closed, and you are willing to cooperate however you can. This will usually entail the bank valuing the assets. If they have value, they will sell them and apply the funds to your loan balance.

Assemble and Submit the SBA Offer In Compromise Package

Once the business closes, and all the business assets are liquidated, you will then be eligible to have your SBA Offer In Compromise considered. This is typically accomplished by submitting the OIC through your lender. Your lender will review the OIC, then forward it on to the SBA (Note: the SBA will want to know if you’ve been cooperative, so play nice with your bank).

It’s important to keep in mind that if your home is being held as collateral, your OIC offer will need to at least cover the amount of equity in your home. If you don’t offer at least that, the SBA is likely to reject your offer. This is because are seeking the highest and best recovery possible. If they have better alternatives to your settlement offer, they won’t hesitate to pursue them.

Once you submit your OIC package, if your offer is strong enough and the SBA approves it, the SBA will release your personal guaranty and any remaining liens on your home once you pay what you agreed to pay to settle the debt. Keep in mind that if you are paying over time, these releases will only come once you’ve paid the entire amount of the OIC.

Before we begin, let’s discuss a few “best practices”. You’ll want to keep these in mind as you work your way through the OIC process.

Don’t Be A Ghost

When business is going poorly, the tendency is to want to run and hide, especially from your lender. Don’t do it. Ignoring your banker is the surest way to tick off her off, and simply invites litigation. Having a banker who likes you is a valuable asset because they are the bank and SBA’s “ears on the ground”. They will know more about your file than anyone. Having a banker who dislikes you can make settlement discussions difficult or impossible. Return calls, letters, and emails that come from the bank. It could mean the difference between settling successfully and having a legal judgment filed against you.

Save Your Pennies For That Upcoming Rainy Day

Once the business is closed and the business assets have been liquidated, this is when the bank will consider your settlement offer. You can only make a settlement offer if you have something to offer (cash and real estate are the two most popular assets), so once you know for sure that you’ll be closing and seeking a settlement, begin preserving cash and looking for ways to raise cash to make an offer. Friends, family, home equity loans, and credit cards are typical sources of cash. Yes, these are not ideal options, but in most cases, there are no “good” options. You are only choosing the best option out of all the crappy options.

Get Your Ducks In A Row

The time to decide what your settlement strategy will be should be well in advance of making an actual offer. If you are working with a professional like me, together, we can devise a strategy together. I don’t use misdirection or shady “strategies”. My goal is to make offers that are fair, reasonable, likely to be approved.

Ask Permission Before Having A Closing Sale

While the idea of selling everything in site to raise cash may sound good in theory, make sure your lender is ok with it. If they think you gave away the store (and their collateral), it could potentially kill your OIC before you even submit it. The last thing you want is to have your banker ask you to kick in more cash because he thinks you gave your inventory away.

Play Nice With Your Landlord

Next to your SBA lender, your landlord may be taking the biggest hit by you going under, as they stand to lose years and years of rent that they were expecting. In order to minimize the damage, try to find a qualified tenant for the space. Whether a landlord will settle depends on a bunch of different factors, such as how easily they can replace you as a tenant, how long the lease was, and if you offered up your personal guarantee on the lease (hint: try not to).

Ok, now that we have those pleasantries out of the way, let’s break the entire SBA Offer In Compromise process down, step by step.

Step 1: Close Your Business and Liquidate The Business Assets

Just like opening a business, closing a business requires a plan of action. This is not, I repeat NOT, the time to curl up in a ball and avoid the giant mess that lays before you. The difference between closing with a plan and closing without a plan is similar to the difference between jumping out of an airplane with or without a parachute: you are going down either way, but careful planning can be the difference between crashing in a fiery heap versus gliding to a smooth landing.

Liquidation of the business assets can happen in a few different ways:

A) Find a buyer for the business as a going concern.

This is not always feasible, especially if the business is going to run out of cash, and therefore you may have no choice but to close the doors. In most cases, you’ll get a higher price for the business as a whole than if you sell it in pieces.

Many people want to know if they can sell the business their friend, then just buy it back later. Essentially, this allows them to settle AND keep their business. This is what some consultants preach as “the way it’s done”. I’ll give you my opinion. It’s not. I consider it to be fraudulent. As a former banker who witnessed these tactics, I can assure you we were not amused.

If the bank and the SBA were agreeable to you selling the business to a friend, then buy it back after you settle, they would simply write down the loan. But guess what? They aren’t willing to do that. These ethically challenged consultants came up with this scheme (or as they call it, a “sophisticated strategy’) because in some cases, clients want to have their cake and eat it to. In other cases, the borrower is desperate and forgets what they say about things that are too good to be true. I’ve written in greater detail about this particular topic here and here.

B) Find a buyer for the individual equipment.

Very often, businesses have competitors or industry contacts that they can reach out to for a quick sale. Banks like it because it saves them the trouble of doing it themselves. Be sure that the bank approves any sale of business assets in writing. The last thing you want is your bank accusing you of stealing their collateral without permission.

C) The Bank will find a buyer.

If you can’t sell the business, and you can’t find a buyer for the equipment, the bank will send an auctioneer to value the equipment. The bank will then either sell it directly to a buyer, or put the equipment in a general auction like this.

D) Abandon the equipment.

If the equipment isn’t worth much (think desks and chairs), the bank will likely just decide to abandon it. If the bank decides to abandon the equipment, that counts as liquidation. In such a case, you can move on to the Offer In Compromise.

(Note: liquidation also includes pledged commercial real estate, so don’t expect to settle unless the building has been sold. A personal residence is an exception to this rule. Your home does not need to be sold in order move forward with the process.)

Step 2: Assemble a Fair, Accurate, and Comprehensive Offer In Compromise Package

Once the business is closed, and the assets have been liquidated, the bank will then ask the “million dollar” question. How do you plan to repay the remaining balance on your SBA loan? When the honest answer is “I can’t”, it’s time to explore the Offer In Compromise.

A) Check In With Your Bank.

Before you start furiously assembling documentation and filling out the forms, it’s a good idea to confirm that your bank is willing to consider an OIC. There are a variety of reasons why a bank might not be interested in entertaining a settlement. This may include:

i. The loan is fully secured with a combination of cash and/or real estate;

ii. You have sufficient income to repay the debt;

iii. On a combined basis the guarantors have the ability to repay the debt in full, or;

iiii. You’ve done something wrong such as selling the assets without their permission.

Think of it this way: The SBA does not settle for the sake of settling. They only settle when they believe a full recovery will not be possible, and settling will result in the highest and best possible recovery from the guarantor.

B) Assemble The Required Financial Documents.

Here is the actual list that I send to my clients once they engage me.

– Form 4506T (get it here)

– SBA Form 912 (get it here)

– SBA Consent to Verify (get it here)

– Last 2 years personal tax returns. As of the date of this post, this means 2016 and 2017 personal income tax returns (federal only, all pages) or if 2017 not ready yet, 2015 and 2016 tax returns.

– If 2017 tax return not ready yet, 2017 proof of income (last 2 pay stubs, or P&L and balance sheet if self employed)

– YTD 2018 proof of income (last 2 pay stubs, or P&L and balance sheet if self employed)

– SBA Form 770 (get it here).

They key to a good 770 is accurate information and full disclosure. The SBA has access to your old PFS from when you first applied for the loan, and subsequent ones as well, so leaving assets off of your 770 is not a great idea. The point of the 770 is to give the bank and SBA a clear view of your personal financial situation. This includes showing them exactly how much you take home every month, and exactly how much you spend. They ask about transfers within the past 3 years because they know people will try to “give” their assets away in order to claim poverty. I could go on, but you get the point here…full and accurate disclosure.

– SBA Form 1150 (get it here)

The 1150 is your opportunity to present your argument. Before I tell you what it should include, let me tell you what it should NOT include. It should not include long narratives about your sad story, and it should not be a low ball offer. If you throw a silly offer against the wall, hoping it will stick, know that by doing so it puts you at risk for litigation or Treasury referral. If they don’t think you are taking it seriously, they won’t waste their time.

The 1150 should convey to the SBA why you can’t pay (be sure to cite documents like pay stubs and bank statements), and why your offer truly does represent the best recovery they can hope for. To do that, you need to examine your situation and look at it through their eyes. Do you have cash or investment accounts (they can usually levy those if they have a judgement)? Do you have a full time job (many states allow for wage garnishment)? Is your home pledged, and does it have equity? If you understand what they believe they can get through what they call “enforced collection” you will have a better understanding of how much you should offer. If you want to know a bit more about why there simply isn’t a definitive formula for calculating the OIC, I’ve written about that here.

– Proof of current liquid assets (bank, brokerage, and IRA statements)

Keep in mind that this list is not comprehensive. It’s the opening salvo. Once the bank or SBA reviews the package, they often will ask for additional information if questions arise about particular elements of your package.

Step 3: Submit The OIC Package, Then Wait

If you’ve read this post, then you know that the process is not a quick one. You can count on the process, from the time you submit the OIC, to the time when your OIC is (hopefully) approved, to take 4 to 8 months. If you get a decision from both the bank and SBA in 4 months, that requires everything to go right, without a hiccup. And to be honest, roadblocks almost always come up at some point. Like a home improvement project, it almost ALWAYS take longer than you’d hope or expect. Between emails, requests for more paperwork, gathering that paperwork, bank committees, time adds up.

So while there are certain things we can’t control, there are a few things you can do to ensure that the process goes as quickly as possible:

- Be Responsive – Be responsive to everyone involved. That includes me, the bank, and the SBA. I understand the temptation to respond to an email tomorrow, or return a call on Monday, but if you exchange 10 emails with the bank with a 2 day lag each time, that adds up to an additional 3 weeks of time.

- Be Accurate and Complete – One major reason that an SBA Offer In Compromise gets held up is that borrowers send me inaccurate or incomplete information. Even when I beg, I sometimes find myself submitting an OIC package that I wish could be better, but when you are up against a firm deadline, sometimes you have to compromise. A less-than-perfect OIC package vs. being referred to Treasury is a no-brainer, but it still irks me because I know it’s completely avoidable.

With all that said, there are some things you can’t control:

- The speed at which the bank works. Understandably, borrowers are often very anxious to get a decision, and are often disappointed to learn that the process is not a quick one. My client often ask me to go over the bank’s head to deal directly with the SBA. That won’t work. The SBA pays the bank to service the loan, so as long as the bank is continuing to service the loan, the SBA will either ignore you or tell you to talk to the bank.

- Appraisals – A borrower’s home is typically the most valuable remaining asset they have. If that home is pledged as collateral, the bank will need to do an appraisal because the SBA requires it. I’ve had OICs either fall apart or go up significantly because the appraisal come back at a higher value than my client listed it on the PFS. Despite client protests, once an appraisal says there is more equity in a property than previously thought, it’s hard to convince the bank to come down off that value.

- The speed at which the SBA works. When you think SBA, think of a black hole. Once your SBA Offer-In-Compromise goes it, it doesn’t come out, and no information is available. You get an answer when you get an answer.

Following Up and Staying Engaged

While it’s fine to follow up occasionally, you don’t want to become a nuisance. Once I submit an OIC package, I usually give it 2 weeks. If I haven’t heard anything by then, I’ll email the workout officer to see if they have had a chance to review it, and offer to get them any additional information that might make their job easier. This process is a marathon, not a sprint. So following up every day is not helpful. Your settlement is not the only file the workout officer is working on, so be respectful of his or her time.

If Your SBA Offer In Compromise Is Accepted

So after many months of blinding paperwork and hard fought negotiations, you get the email with my two favorite words: SETTLEMENT APPROVAL! Great, now what?

1) Make sure that your settlement is documented in writing.

Verbal promises are not acceptable, not with this amount of money on the loan. The last thing you need is to have a collection company come calling and not have any proof that you settled the debt.

2) Involve your attorney.

My job is to negotiate the settlement, but as I tell all me clients I am not an attorney, and therefore I always strongly suggest having an attorney review all legal documents. With so much on the line, paying a few hundred dollars to ensure all the i’s are dotted and t’s are crossed is well worth it.

3) Ensure that all parties, including both the SBA and the bank, have approved the settlement terms.

Many banks will defer to the SBA, and go along with whatever the SBA approves, but that doesn’t mean you should make any assumptions. Get it in writing that the bank is on board. Nothing would be worse than finding out that bank still wants money above and beyond the settlement.

4) Make sure you can honor the settlement terms.

Banks and the SBA will usually give you and extra few weeks to pay if you have a good reason. Just be proactive about it. It’s much easier to get extra time by asking at the time of approval, than it is to ask for more time at the last minute (then bite your nails awaiting an answer).

What About Documentation?

Settlement documentation will vary from bank to bank. Some will have their attorney draft a comprehensive settlement agreement. Other will send you a one-page letter. The SBA doesn’t even do that….they send an email. While a settlement agreement that lays out all the details in a proper legal document is preferable, borrowers frequently face the reality that they can either move ahead with the OIC with what they have (warts and all), or don’t move forward at all. But don’t fret, I’m yet to hear of SBA welshing on a settlement approval regardless of how poorly documented it may be.

Your SBA OIC is Declined: What To Do?

It sucks, but OICs are often declined. But I have good news. Having your initial settlement offer declined is not necessarily the end of the road. However, it does require some self-reflection and triage. The bank or the SBA gave you a big “thumbs down”. Not the end of the process, but now is the time to get inside your banks or the SBA’s mind.

The easiest way to find out what their thinking? Just ask! I usually phrase it is as something along the lines of “Thanks for your email. I thought the offer was a representative of my client’s ability to pay, but obviously the bank/SBA doesn’t agree. Would you be able to give me any insight as to where our views differ?” Then you can go on to explain exactly how you arrived at your offer figure, and give them a chance to explain what part(s) they see differently.

Frequently Asked Questions About SBA Default

I’ve laid out the process for the SBA Offer In Compromise above, but I know you probably still have questions. Below are the most common questions I get, in a “Q&A” type format.

Is it possible to settle an SBA Disaster Loan?

It’s not impossible, but it’s very difficult. For that reason, I don’t handle them. The people who work on disaster loans don’t appear to be interested in settling.

They are, however, very interested in collecting tremendous amounts of paperwork. And they love asking for more info on top of more info. It’s almost as if the goal is to frustrate you into giving up.

In the event that they actually do render a decision, it’ll be arbitrary. Have no income, no assets, and owe $1 Million? Ok, we’ll take half, please. What a waste of everyone’s time.

How long will it take to settle my loan?

See step 3 above. But just to reiterate, you can plan on 4 to 8 months from the time you submit your OIC. There are many factors that determine the overall length of the process. Factors such as the need to liquidate equipment or real estate, and whether or not you are dealing directly with the SBA.

I’m working on an OIC right now that’s coming up on a year. From the start, whatever could go wrong has gone wrong.

First, my client was way off on the assessment of his commercial properties. So instead of no equity, he has $150,000 in equity. We had to get appraisals (about a month), then he had to sell one of the properties (2 months).

Next, we submitted the OIC and the workout person had lots of followup questions. Every time we gave an answer, he come back 2 days later with more questions. Just to make it really fun, if we had a question for him, we got partial or unclear responses. That took 2 months.

Eventually, the bank agreed to submit the OIC to the SBA, so we sat tight and waited for a decision. (2 months)

Two months later, I followed up with the banker. He followed up with SBA, who said they never got the OIC package. So he had to resubmit (another 2 months).

We finally got a response from the SBA: a counteroffer. The counter actually didn’t make much sense. They were claiming my client’s net worth was high because he has equity in a different property. That was BS. The person at SBA was taking market value minus mortgage balances to determine equity. I’d never seen the SBA do that in 10 years of doing this.

We disputed their analysis. They then requested an updated PFS. Then asked ridiculously detailed questions that could not possibly matter. In other words, we were dealing with a new person who was asking questions for the sake of asking questions.

So here we sit, 12 months after my client’s initial SBA loan default. Any day now, we should get a final decision from the workout officers boss. He told us we should have a decision 2 weeks ago. But we’re still waiting.

What can an SBA workout specialist do for me that I can’t do for myself?

Ah, the question you are too polite to ask.

A knowledgeable SBA workout expert will not only have knowledge of the SBA settlement process, but experience too. Just because someone reads the SBA SOPs doesn’t mean that they’ll know how these things go in the real world. Fair or unfair, the SBA doesn’t always follow the letter of their own rule book.

To further complicate matters, different office interpret the SOPs differently. No amount of reading will fill you in on that kind on inside knowledge. An experienced SBA workout pro knows the SBA rules knows when to challenge the lender, and when to accept realities that won’t change. As a business owner who is going through the settlement process for the first time, it’s virtually impossible know all the SBA rules and practices.

Wow, that all sounds like a bunch of sale pitch mumbo jumbo. Let me give you some concrete examples of what I know that you don’t:

- When you are filling out the PFS, how you calculate monthly income matters. How to treat bonuses, retirement contributions, and bi-weekly vs bi-monthly paychecks all can impact the final number.

- How to handle a workout officer who is telling you an OIC is required, when it’s actually not. I’ve got the actual SBA servicing document that dictates that very thing.

- How to handle retirement accounts. Should be they be disclosed? Can the bank consider them since they are protected from creditors?

- When you are 6 months away from closing the business and not even in default, what important steps do you need to take to prepare for the upcoming SBA OIC process? There’s one HUGE thing you need to do.

- What kind of thing are considered fine to do, and what’s considered to be fraudulent? Hint: some minor things that may seem like no big deal can mean the difference between settling and ending up at the Treasury.

What’s the worst that can happen to me if I default on an SBA loan?

I’m not trying to scare you, but there can be some very severe consequences to that you should be aware of.

Banks can foreclose on a home that has equity in it. They can force your business to close, and sell all the business equipment. They can obtain a personal judgment against you in court, then subpoena you for information. If you don’t respond to the subpoena, some states allow you to be arrested (to my knowledge, it doesn’t happen very often).

Home, Sweet Home

Even if you didn’t specifically pledge your home as collateral, some states allow a judgment lien to be placed on your property which will remain there until you sell the property.

Here’s one giant misunderstanding that I hear from time to time. Just because you’re lender is not in a first lien position on your real estate, that doesn’t mean they can’t foreclose. Let’s look at an example:

Your home is worth $300,000. You owe $150,000 on your residential mortgage. Your SBA loan for $100,000 is in a 2nd lien position.

I’ve had more than one potential client say something to the effect of “but they can’t foreclosure because I have a mortgage on my home that’s ahead of the SBA loan”. Sorry, that’s not right. If the SBA lender feels there is enough equity in the property, they CAN foreclose. Yes, the first lender would need to get paid first. But if there is enough equity, the SBA lender won’t care.

These are all reasons why you should be proactive about settling.

When I make a settlement offer, does it go through my lender or directly to the SBA?

It depends. In most situations, the lender will service the loan until they feel that all avenues have been exhausted. Once the lender reaches that point, the file is “wrapped up” and referred to the SBA for further collection efforts. Once the matter is referred to the SBA, the borrower and guarantors will typically get a letter from the SBA.

If you receive such a letter directly from SBA (sometimes referred to as a “60 day letter” letter), your lender may no longer be involved in the negotiation, and you are free to deal directly with the SBA. Interestingly, sometime the SBA will send you back to your lender even after you get a 60 day letter. Confusing, I know.

BTW – If you try to deal with the SBA directly while your bank is still servicing the loan, chances are that they will refer you back to your lender.

I never heard from my SBA lender. Am I off the hook?

Probably not. Just because your bank isn’t breathing down your neck, it doesn’t mean you won’t have to deal with issue.

I often hear from people who stopped paying years ago, assumed the matter was dead and buried, only to get a letter from the US Treasury (or a collection company on their behalf). Once it gets to Treasury, it’s unlikely to settle.

Bottom line: don’t use their silence as an excuse to avoid dealing with your SBA default. Many lenders are more than happy to refer the file to their SBA attorney or the Treasury. Neither of those scenarios is an easy path to settlement.

When I was a workout officer, the easiest way to get a file off my desk was to have a non-responsive client who wasn’t worth suing. “Sorry SBA, they aren’t worth pursuing. Here you go”. That’s so much easier than having to having to slog through the OIC process.

I’ve also had plenty of people tell me that they spoke with an attorney, who recommended they wait to settle on their SBA default. The theory was that the longer you wait, the less the SBA will settle for. That theory is probably true for most types of debt, but NOT for SBA loans. (Pro tip: just because someone is an attorney, it doesn’t mean they know the best way to handle an SBA loan settlement.)

My bank is telling me that SBA loans cannot be settled. Is that true?

No, but that’s a good indication that your bank(er) has no clue what they are doing, or they are simply posturing. A telltale sign that they don’t know what they are doing is when they say something to the effect of: this is an SBA loan, so regular rules don’t apply here.

With that said, there are certain situations in which a settlement is not possible, such as:

- There is sufficient collateral to repay the debt in full.

- The business remains open and operating.

- The guarantors can afford to repay the debt in full.

- The borrower or guarantor has engaged in fraud or misrepresentation.

I paid too much for my business. Will my lender/SBA reduce the principal amount I owe so I can afford the payments?

Unfortunately not. The only way that the SBA will consider a settlement is after the businesses ceases operations and all business assets have been liquidated (Note: some exceptions do apply). Some people get awful advice and will sell the business assets to a related party (friend, relative, business partner etc), then buy them back later (see my article on Ethics and Legality of an Asset Dump Buy Back). Unless you fully explain the true nature of your transaction to decision makers at the bank and SBA, it’s fraudulent.

The most emotional clients I have are usually those who feel that the bank should never have approved the loan to begin with. Some people throw out the term “predatory lending”. In general, I do sympathize with my clients. SBA loan default is a nightmare of a situation. But when it comes to this point, I usually find myself defending the bank.

Banks are not omniscient. They make educated decisions when they approve loans, but the fact is that they have no idea which loans are going to default. Beyond that, their underwriting of the loan is done for their benefit, not yours. They are trying to ensure they get repaid. They are NOT there to save your from yourself. Buying a business and the price you pay is up to you to figure out. They make money when people repay loans. To suggest that your SBA lender knew that you’d default is, in my opinion, a bit of a stretch.

The SBA guaranteed 75% of the loan to my lender. That means as a guarantor, I only owe 25% of the balance, right?

Unfortunately, that’s not how it works. Regardless of how much the SBA reimburses the bank for, you are still responsible for the entire balance. The SBA guarantee has no impact on how much you, the borrower, legally owe.

The SBA guarantee is for the bank, not for the guarantor. Still unclear on what that means?

I’ll give you an example:

I took a loan for $500K to open Jason’s Super Pizza Palace. On opening day, everyone gets violently ill, and I close the business almost immediately. My business is now closed, and I still owe $500K. The bank I took the loan from shows the SBA that they did everything right, and this default was not due to them missing something obvious during the underwriting phase of process.

Since there was a 75% SBA guarantee, the SBA send the lender $375K (75% of $500k). Guess how much I still owe? $500K. All that’s changes is that going forward 75% of any money collected must be remitted back to the SBA.

The reimbursement by the SBA does not change the amount owed by the borrower and guarantors.

Do I need a lawyer to settle my SBA debt?

No, and here’s why. Settling SBA debt is largely a financial matter. While I’d recommend having an attorney review legal documents such as settlement agreements, in many cases SBA settlements often involve no signing of any agreements at all because all they give you is an approval letter (which you can still have your attorney review). When engaging someone to represent you, you need someone with a through knowledge of the SBA process (most lawyer’s don’t), and an understanding of the philosophy behind SBA settlement policies.

I’ve gotten numerous calls over the years from attorneys who are attempting to navigate an SBA loan default on behalf of a client. Once they start doing a little digging, they come to understand that in order to successfully settle an SBA loan, it requires an intimate knowledge of the SBA OIC process. They look around the internet, and ultimately turn to me, recognizing what’s needed is someone who knows the process from the inside, not a law degree. My 10 years of full-time experience handling ONLY SBA default doesn’t hurt either.

If I want to settle my debt, I sell my business assets, turn over the cash to my lender, and then I’m all done, right?

Sorry, selling the business assets is just the first step (see above). Offer In Compromise negotiations begin after that. The OIC is about one thing: releasing your personal guarantee. The OIC is a separate event from business asset liquidation.

Many people don’t understand the what the personal guarantee means. Shame on whoever was advising them at loan origination. Personal guarantees are a big deal. It means that even after the business assets have been sold, the bank is going to look to you to cover the remaining loan balance.

I’ve had more than one person tell me “no, no, no, I have an S-Corp. That protects me from personal liability!”

No, friend, it doesn’t protect you from personal liability. Why?

Because of the personal guarantee. Had you not personally guaranteed it, it would be a different story. But banks are smart, and they understand that in most cases, an S-Corp isn’t worth much, especially in a default or liquidation situation. That’s why that (almost) universally require personal guarantees when it comes to SBA loans.

I’ve had people open lament the fact that they gave their personal guarantee. I tell them not to beat themselves up too much. Had they not given the guarantee, they most likely would not have gotten approved for the loan. And in 18+ years of working in commercial lending, I can’t recall any SBA loans without at least a partial guarantee.

I have a business partner, and we both personally guaranteed the debt. Am I only liable for 50% of the debt?

In most cases, personal guarantors sign unlimited personal guarantees. This means that you are both responsible for 100% of the debt. Therefore, they will pursue both of you for the full amount. In many cases, one guarantor is has a stronger financial profile than the other. Guess who they’ll go after first.

I personally guaranteed the loan as a favor to a friend/family member. I had nothing to do with the business. Shouldn’t that count for something when they are considering my Offer In Compromise?

Not as far as your lender and the SBA are concerned. The whole reason they initially asked for your personal guarantee was because the business and business owners did couldn’t qualify on their own. Any lender in the world will expect you to honor a personal guarantee. Why you agreed to it at loan origination doesn’t matter.

When I first took this loan, I pledged my home as collateral. My lender said the bank would release the lien after 12 months of on-time payments, but now they won’t. What gives?

It’s important to recognize who made that promise to you: a sales person whose job is to bring in loans. Unfortunately, they will tell you things with a wink and a nod. In reality, they have no business committing to such things. Unless you have it in writing, it will be almost impossible to get the bank to honor such a thing.

If I file for personal bankruptcy, can the bank still legally come after my business and shut me down?

They can absolutely shut your business even if you file for personal bankruptcy, assuming the business assets are owned by your S-Corp, C-Corp, LLC etc. Having your personal guarantee discharged only relieves you of personal liability. In other words, they can’t go after your personal assets (unless you pledged them as collateral). Your business is still fair game.

When I took this SBA loan, I formed a corporation. Doesn’t this shield me from any personal liability?

The part you are forgetting is that you personally guarantee the loan. Unfortunately, the bankers know this fact too. That’s why in almost every case they require a personal guarantee from the business owner. By doing this, you are essentially saying “I agree to use my personal resources that I owned outside the business to repay this loan”. And you can bet they’ll want to hold you to that.

I get it. It can be really infuriating when you feel like you were duped. Especially when your own advisers failed to explain what you are signing up for. But the reality is that the banks are pretty good at making sure they don’t lose money. Their livelihood depends on it. At some point, way back when, some guy formed a corporation. He took a loan, promptly defaulted, and walked away. And the bank said “yeah, that didn’t work out the way we wanted it to. We should ask the actual person behind the business to guarantee repayment”.

There are definitely advantages to forming a C-Corp, S-Corp, or whatever other options exist. But when it comes to taking an SBA loan, shielding your self from being personally liable from the loan isn’t one of them because of the fact that the bank requires a personal guarantee.

And just to preempt your question: It’s highly unlikely that you can obtain an SBA loan without personally guaranteeing it. It’s typically non-negotiable.

Does my business need to file for bankruptcy in order to qualify for a settlement?

No, in most cases, just ceasing operations is sufficient for the SBA. There may be strategic reasons for filing a corporate BK. Doing it to qualify for an OIC is not one of them. The SBA only cares that your business has ceased operations, and that all the business assets have been sold.

Notice that I said business assets, not all assets, need to be sold. Keep this important distinction in mind if a bank workout officer ever tells you that you are required to sell your home in order to qualify an SBA Offer In Compromise. Because if they do, they are flat out wrong.

While selling your home is not required, it my be a necessity in order settle your SBA loan and avoid foreclosure. For example, let’s say you default on a $1 Million SBA loan, and your home (that you pledged as collateral) has $500,000 in equity in it. If you can’t raise that kind of cash, the only way to raise it (assuming you can’t borrow) for many borrowers may be to sell.

Will the bank be able to foreclose on my home if I file for personal chapter 7 bankruptcy?

First, you should run any BK questions past a BK attorney, but I’ll tell what I learned as a lender. If there was a lien on your home prior to the bankruptcy, then the lien will not be extinguished if there is equity in the home. If there was not a lien prior to the bankruptcy, then I believe that having your personal guarantee discharged will protect your home from a judgement lien.

I met with a bankruptcy attorney, who recommended that I file for bankruptcy. Why should I try to try to settle the debt instead?

I believe that there is a place for both bankruptcy and Offer In Compromise. Do some homework, gather all the facts, then make an informed decision. Whichever approach you take will have it’s own unique pros and cons. The key is to fully understand your options so you don’t rush into something that you’ll later regret.

Will settling an SBA loan impact my personal credit?

For years I have been telling people settlements had no negative credit impact. If your bank never reported to the credit bureaus to begin with, then it would be all good. Then I got a note from a client that their SBA loan settlement had resulted in a credit report entry. Then, I heard it again from a different client a few weeks later. In both cases, I negotiated DIRECTLY with SBA (not sure if that is coincidental or not). I’m happy to report that both clients successfully challenged the information, and the bureau remove the information from both reports.

If I settle, will be able to get another SBA Loan?

Highly unlikely. If you borrow from the SBA, and don’t pay it back, they are going to put you on the CAIVRS list. Any federally subsidized programs like FHA and government guaranteed student loans will be hard to obtain as well.

I got a 60-day letter addressed to my business. What should I do?

I actually got a call about this today. In this case, the business ceased operations years ago. It had no assets or income. I asked the caller if he planned to ever use that entity again. He did not. So in that case, I don’t see any reason to do anything.

But let’s clarify something here. The letter was addressed to the business. If there is no personal liability, then if it were me, I’d do nothing.

Why would I do nothing?

If the business has no income or assets, and is going to never operate again, the SBA has no recourse here.

Let me say it again: this is only applicable to situations when only the business is liable. If you got a letter addressed to you personally, you need to deal with is ASAP. If you ignore the 60-day letter addressed to you personally, it will go to Treasury!. I promise, you don’t want that.

Will the SBA accept a payment plan for an Offer In Compromise?

They will consider monthly payments, but as SBA Form 1150 states, they prefer a lump sum.

Clients frequently want to know under what circumstances the lender and SBA will consider a payment plan. The way I see it, it’s in situations when the guarantors circumstances call for it. So if you have no way to raise cash but you have a steady source of income, it makes sense for them to approve a monthly payment. But if you have a lump sum just sitting in the bank and you’re unemployed? That screams for a lump sum.

While the SBA will consider a payment plan, it’s important to keep in mind that your lender needs to approve any OIC terms prior to it being presented to SBA for final approval. This means if your lender isn’t interested in a payment plan, they have the right reject the OIC. And you can’t go over their head to the SBA.

Does my business need for file for bankruptcy in order to settle my SBA loan default?

I’ll start with a disclaimer: I’m not an attorney, so please don’t consider this to be legal or bankruptcy advice. If you have legal or bankruptcy questions, you should consult with a licensed attorney in your area. I’m just giving you my general perspective from my years in the business.

Here’s what I want to say about business bankruptcy as it relates to SBA Offer In Compromise:

No SBA Requirement

- The SBA does NOT require a business to file for bankruptcy in order to be eligible for an OIC.

You Are Likely Still Personally Liable

- If you file for business bankruptcy, it does NOT release you from personal liability. I can’t tell you how many people are completely dumbfounded when I explain this. Many people think that because they have an LLC, S-Corp, C-Corp, etc, that it shields them from any personal responsibility as it pertains to their SBA loan. This would be true if the bank didn’t require personal guarantees from the business owners, but they ALWAYS (except in extremely limited circumstances) require a personal guarantee. So even if the business fails, files for bankruptcy, or has no assets, you are still going to have to deal with your personal guarantee. That’s the whole point of the SBA Offer In Compromise.

What’s The Benefit of A Chapter 7 Business Bankruptcy?

- Here’s a question that I’d love to hear from a bankruptcy attorney on. For most small businesses, I don’t see the benefit of a chapter 7 bankruptcy. That’s the kind where the business closes, and they sell everything. In my years as a workout officer and consultant, my experience is that most businesses don’t file for chapter 7. And that actually makes a lot of sense to me. Let’s say your business is closed, has no income, and has no assets. What does it really have to gain from a business bankruptcy?

I think about it this way. When you default on creditor (lender, vendor, etc), they asses their collection options. If you don’t have anything for them to take, they really have no other options. If your business has nothing, what’s the benefit of filing a chapter 7 bankruptcy? As long as you don’t ever use that business entity in the future, what recourse do they have?

To be clear, I’m NOT talking about personal bankruptcy here. I’m talking about business bankruptcy.

I got a 60-day letter from SBA addressed to my business. What should I do?

If your business is closed and has no income or assets, most people do nothing. Just be sure to never use that entity again.

Let’s make a distinction. Your business entity liability is not the same as your personal liability. I’ll say it again. Your business entity liability is NOT the same as your personal liability.

Your business getting a collection letter, it’s not the same as YOU getting a collection letter. Assuming you are not personally liable (due to a settlement or BK), then the worst that can happen is the SBA can go after the business entity. If the business is closed, has no income or assets, then there is nothing for the SBA to come after.

It’s important to remember that if you are not personal liable for the debt, the lender can’t go after your personal assets. People often panic when they get a 60-day letter addressed to the business. They panic because they think the SBA can come after their personal assets. Unless there is a personal guarantee, or your personal assets have been pledged as collateral, they can’t!

You seem like a good guy, Jason, but how can I know that you are right about all this?

Here are some links to various SBA articles by some well known financial companies like value penguin, lendio or nerdwallet. Feel free to compare notes on the basics. For the record, it drives me nuts that Google search results favor all these site over mine for the two most searched for phrases. SBA loan default and SBA default. Anyone searching these phrases would clearly benefit more from my website.

Questions To Ask A Potential Debt Settlement Advisor

- What is your experience with financial statement analysis (both personal and business)?(Note: as a former banker with 16 years experience, I routinely analyzed all types of financial statements, tax returns, and personal financial statements. As a consultant, I know exactly what the banks and SBA focus on when looking at your financial info and what happens in case of SBA loan default. It’s important to note that many SBA settlements go through intermediaries such as a bank, so there is no direct negotiation going on with the SBA. This fact makes it crucial that your SBA expert have a strong grasp on how the SBA thinks. )

Have you ever settled the type of SBA business loan I have?

There are a number of SBA business loan types (504, 7a, and Express are the most common). They are all settled in different departments. Therefore, settlement offers are viewed differently in different SBA departments. Not understanding the difference between all the business loan types could mean your consultant is “winging it”.

Will I work with the business owner featured on your website?

Self promoting note: I personally handle all my client’s files. What specific SBA settlement and SBA loan forgiveness experience does the SBA attorney handling my file have?

What specific experience do you have that qualifies you as an SBA settlement expert?

Can you provide a list like this of SBA loan settlements you’ve obtained for clients?

Do you have any literature (website, blog, pamphlet etc) where I can get a better feel for the depth of your SBA settlement knowledge?

- Is SBA settlements all you do, or do you focus on a number of areas? (Note: 99% of my business is SBA settlements. I live it and breath it all day, every day. That’s what makes me an expert).

Distressed Loan Advisors (http://www.JasonTees.com) offers expert advice about dealing with SBA Loan Default and SBA Loan Forgiveness, and can be reached at . or ..