Hey! My name is Jason. I’ve been helping SBA borrowers who are struggling since 2009. If you came here looking for EIDL help, I’ve listed all my resources HERE.

If you want to book a 1-on-1 case evaluation with me, you can do that HERE.

October 2023 Update:

As far as I know settlements of EIDL loans are still not being approved. But I’ll keep my ear to the ground. The easiest way to get the most updated info that I have is to check my EIDL page, my Blog (EIDL specific posts HERE) and follow & subscribe to my Youtube Channel.

Deferments aka Hardship Accommodations:

If approved, they will grant up to 2 separate deferments with a 10% payment (6 months each, for a total of 12 months). After that, approved deferments allow for 50% of the regular payments for 6 months. After that, it goes to 75%. What happens after that is anyone’s guess. I’m hoping OICs will be possible by then, but only time will tell.

April 2023 Update:

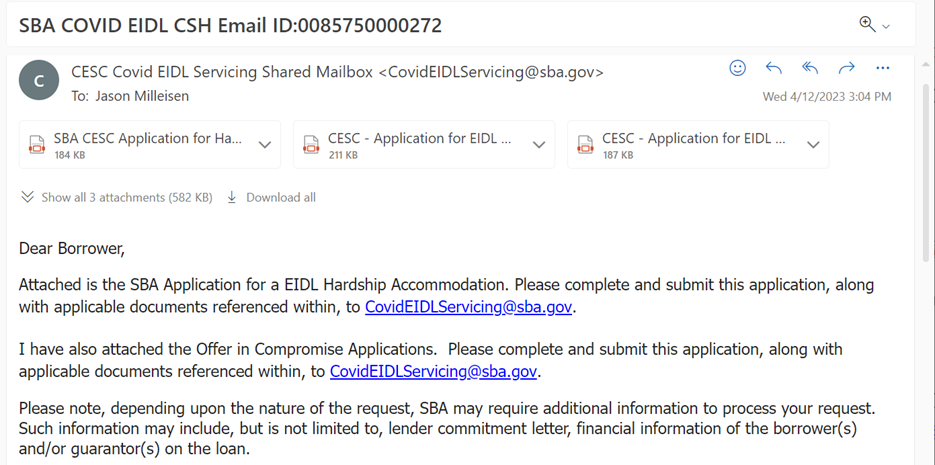

Okay, so after a couple years of wondering if (or when) the Offer in Compromise would be an option for SBA EIDL loans, I finally got an email last week from the SBA (see screenshot below.)

In addition to the hardship accommodation application, they also provided me with application and checklist for offering compromise for loans both over and under $200,000.

This is obviously great news, and a step in the right direction, however I’m not going to pop the champagne cork just yet.

While we can certainly submit the EIDL OIC paperwork, it’s not clear at this point how flexible or inflexible they’re going to be when it comes to partially forgiving your EIDL loan.

The first thing that any potential borrower who’s interested in a settlement needs to know is that historically, the SBA requires businesses to be closed or sold prior to any offer in compromise submission. This means that if you want to keep your business open, Offer in Compromise may not be an option.

The other thing I want to point out is that just because the SBA is willing to consider settlements, it doesn’t mean that it’s necessarily the right move for you.

If you’ve got a loan that does not have a personal guarantee, and the loan is through a legal entity, there may not be a tremendous upside to making a settlement payment out of pocket.

Now, let’s assume that your business is closed or sold, and you did personal guarantee your EIDL loan.

In such a case, if you don’t have the income or assets to repay your EIDL loan in full, offer in compromise might be worth pursuing.

BUT, as I’ve written ad nauseam about other types of SBA loan types, not everyone qualifies for partial SBA loan forgiveness. As I’ve said lots of time in my 15 years of doing this, settling your SBA loan is not a right. The SBA is not required to settle with you.

I started doing this in 2009, and it’s always been fairly consistent that in order for you to be eligible for a settlement, you need to provide full financial disclosure, and demonstrate to the SBA that you truly lack the ability to repay your loan.

Practically speaking, this means if you owe them $250,000, and you’ve got that much in your bank account, or in the form of other assets like real estate, it may be difficult to settle.

For the SBA, the decision to settle your EIDL loan, or any SBA loan for that matter, is really a business decision.

They need to decide whether or not the offer you’re making them will result in the best possible recovery.

If they think your offer is their best option, they should take it. If they think that you have enough assets to pay off the loan, or there are ways that they can forcibly take the money from you, then they should be rejecting the offer.

One of the most popular questions that I’ve gotten from people over the years is of course “how much can I settle for?”. The answer is that there’s no set percentage or amount that the SBA is looking for.

While I do list results from prior settlements on my website, those are numbers that I “back into”. In other words I rarely go in a settlement saying to my client that we’re going to offer a certain percentage.

Instead, we figure out what they can afford based on their circumstances. I always look at what the offer is as a percentage of total, because I know there are certain critical minimums that they look for.

Just to make this thing a little bit more fun, everything I’m talking about with regards to OIC protocol is based on my past experience with regular SBA loans (i.e. not EIDL loans). Until we get a few decisions back on EIDL settlement offers, we really don’t know how strict or lenient the SBA is going to be in reviewing EIDL offer in compromise packages.

If you’re not sure if an offer in compromise is the right way to go for your EIDL loan, I encourage you to schedule a case evaluation here. The fee for the case evaluation can be applied towards my consulting fees should you choose to hire me to assist you through the offer in compromise process.

As I’ve been doing for the past couple of years now, as I gather more information about how the offer in compromise process plays out for e ideal loans, I will give an update through all of my various channels.

January 2023 Update:

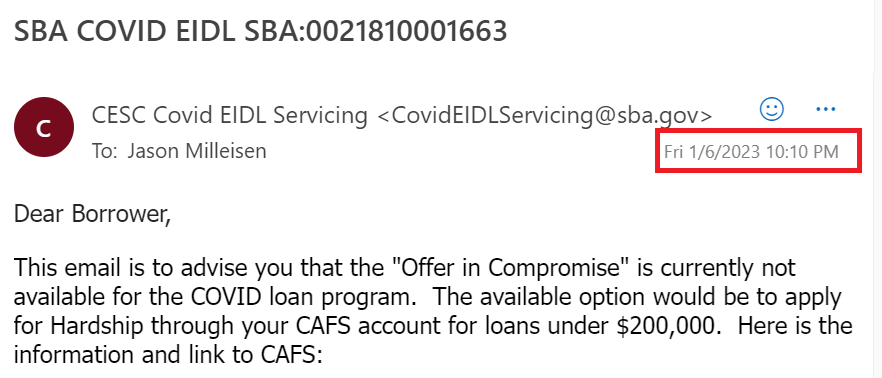

It’s January 2023 and I’ve been reaching out to the various SBA offices that handle EIDL loan servicing to inquire as to where they stand on deferments, modification, and Offer in Compromise (aka settlements).

First, they send A LOT of automated emails, so getting a reply from an actual human is not always a forgone conclusion.

After several rounds of me replying with “Thanks for the info, but I have a very specific question, I’m a consultant and I’m getting dozens of inquiries per week. Specifically, borrowers want to know if the SBA is currently considering Offer in Compromise for these SBA EIDL loans that were issued during COVID. Can you advise?”

Finally, last night, I got a direct answer to my question: NO, the SBA is NOT currently entertaining Offer in Compromise request on COVID EIDL loans. Here’s a screenshot of the email:

If you’ve read my previous updates, the lack of Offer in Compromise as an option for EIDL loans is a departure from all other types of SBA loans. I’ve been consulting on SBA workouts and settlements since 2009, and EVERY OTHER TYPE OF SBA LOAN has an Offer in Compromise process.

So why are they choosing not to offer OICs for COVID EIDL Loans? I think the answer comes down to a numbers issue. Millions of EIDL loans, and a fairly understaffed SBA, many of whom don’t have a lot of experience.

The SBA basically has a “flow chart” that reps use to determine their actions. This probably works ok when explaining how to access your loan documents or how to apply for a deferment, but an Offer in Compromise is a completely different animal.

Besides that, if the SBA did start considering Offer in Compromise for COVID EIDL loans, they know that there would likely be too may request to process. It could literally take years to process them all.

So for now, I’m thinking the SBA is taking a “wait and see” approach. Kick the can down the road, and see how quickly the herd thins.

Now that we know that the OIC is not on the table (for now), I do have some thoughts on what people should be doing if their business closes, if they can’t afford their loan, if they personally guaranteed their EIDL loan, if they DIDN’T personally guarantee their loan, and on and on.

In case you missed it above, the above questions are ones that I specifically address in the 90 minute audio course or in the 30-minute 1-on-1 consultations.

August 2022 Update:

Hey guys, it’s now August of 2022. And I just wanted to give an update as to where things stand.

When I first wrote the article, I stated that nobody was really sure what was gonna happen with regards to EIDL loan forgiveness. Unfortunately, as of today, the mystery still remains because the majority of EIDL loans are not required to begin payments until October or November of 2022.

There are very few test cases at this point to see what the SBA’s appetite is for settlements. With that said, I can dispel some information that I’ve read online, particularly on Reddit here and here. And quite honestly, people have no idea what they’re talking about.

So first let’s dispel the myth that bankruptcy is your only option. I’ve heard people say this for years about SBA loans, when I know full well that SBA loans can be settled for less than the full balance.

Now, can they be settled in all cases? Of course not. You have to demonstrate that you don’t have the ability to pay them. And then in those cases, they will consider some level of forgiveness.

But I was on an EIDL subreddit, where somebody asked the question “will SBA EIDL loans be forgiven?” and you get, and it really drives me crazy to be honest with you, watching random people who know absolutely nothing about the process or the business who will say “Absolutely not! These are government loans. They’ll never forgive them. PPP was the only free money!” Zip it pinheadsteve2332!

This could not be further from the truth. If the SBA treats EIDL loans, like they treat every other type of loan, they should have an process to consider forgiveness via the SBA Offer in Compromise.

Side note: disaster loans have been around for a long time. They weren’t invented during COVID, but they gave out more during COVID than they probably did in the previous 10 years combined. typically disaster loans are reserved for situations where there’s floods, hurricanes, tornadoes, stuff like that.

Over the years, I’ve gotten calls about SBA disaster loans. I’ve attempted to settle some of them. Most of the time, they’re pretty difficult to settle.

That said, nobody’s actually settled one of these COVID EIDL loans yet. So we don’t know what’s going on behind the scenes. And when I say behind the scenes, keep in mind that political influence and upcoming elections and polling, all that stuff plays into it.

So I’m not saying that I know what’s gonna happen, but what I am saying is it’s certainly possible that as the 2024 election comes near that all of a sudden the federal government will consider forgiving a portion of these EIDL loans.

Even if they don’t do a blanket forgiveness, it’s certainly possible that anyone who applies for forgiveness will automatically get some level of forgiveness.

Again, I just want to be clear. I’m not saying I know any of this to be fact, I’m just guessing based on my 10 plus years of experience of settling SBA loans of all types, including disaster loans.

Other common things that I see people saying online, that just aren’t true, include that the government will never forgive any portion of these loans, because if they get, they did, they would have to forgive every other type of SBA loan.

I can tell you from experience, that’s just not true. The SBA, other than the PPP loans and the grants, they certainly don’t give away money, but it also doesn’t mean that they’re not willing to forgive a portion of it.

If you can demonstrate to them that, that you truly have no way to repay it. I give the government some credit here for understanding that you can’t get blood from a stone. If someone is seeking EIDL loan forgiveness, and they can demonstrate beyond a shadow of a doubt that there’s no chance that they can pay it back, the government (in my estimation) will consider taking something less than the full balance.

At this point. There’s no one out there who knows for sure how this is all gonna play out. It’s possible that these get deferred another six months, it’s possible that they don’t have a settlement process for them.

We don’t know for sure, BUT what I do know is every other type of SBA loan, there is a mechanism for settling them. So it would stand to reason that this would also be the case with EIDL loans.

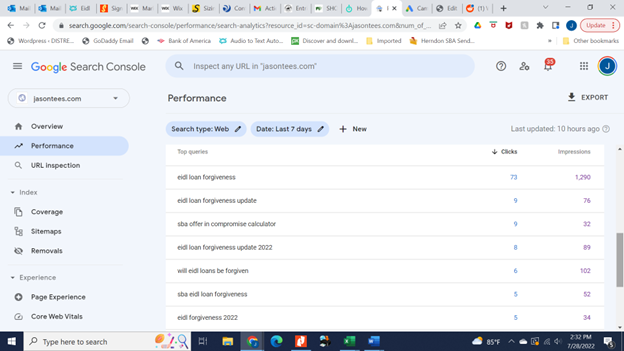

One last thing that I absolutely know for sure is that more and more people are searching online for answer. Look at all the recent top keywords that led people to this site:

Original article from March 2022:

Today, I want to talk about EIDL (Economic Injury Disaster Loans) loans that were provided by the SBA during COVID. I get a lot of questions about it from confused borrowers.

Everyone knows that regular SBA loans can be settled. Primarily, I handle the SBA 7a loans. I have handled hundreds of those over the years.

Because EIDL loans are relatively new to most people (they’re actually new to guys like me, too), it can get confusing as to what your options are if you’re unable to repay your EIDL loan.

The main question that people ask is can an EIDL loan be settle through the offering compromise process, like a regular SBA loan. The answer to that is that you can submit a settlement offer through the offer in compromise process, but at this point it’s unknown what the SBAs appetite is to settle these types of loans. I know that’s not a great answer.

Because the concept of settling an EIDL it’s all relatively new to us. It’s hard to give guidance as to whether or not the SBA will give serious consideration to settlements. I can tell you when I first started out, I tried to settle SBA debt that had been referred to the US Treasury.

I assumed that the process for settling with the Treasury (sometimes called the Bureau of Fiscal Service) was the same as settling with the SBA. I could not have been more wrong.

When things get referred to the US Treasury, they’re typically very difficult to settle. How difficult is hard to say, but definitely more difficult than if you tried to settle directly with the SBA or through your lender.

So when we’re looking at the prospect of settling EIDL loans, it’s a little bit of a crapshoot at this point (March 2022). With that said, there are certain situations when it makes sense to attempt to submit an OIC for your EIDL loan, and others when you are better off not submitting an Offer In Compromise.

When the SBA gave EIDL loans, they limited personal guarantees to loans over $200,000. This means if your loan was $200,000 or more, they likely did require you to personally guarantee the debt.

On the flip side of that. If you borrowed less than $200,000, this means that you likely did not sign a personal guarantee. There’s a world of difference between those two scenarios.

Now, just because you’re not personally liable, doesn’t mean that there’s nothing that the SBA can do to collect from you, but it’s certainly more advantageous to not have offered your personal guarantee.

I would venture to say that most borrowers who offered a personal guarantee really should explore ways to resolve it without it being referred to the Treasury.

If you’ve read any of my articles about the Treasury, you’ll know that the vast majority of them don’t settle. It’s unfortunate, but that’s the reality.

I spend a lot of time explaining people’s options regarding SBA files that have been re referred to the Treasury. But in most circumstances, part of that conversation includes explaining that a settlement isn’t very likely.

Just yesterday, I had a consultation with a gentleman who owes $800,000 on a former SBA disaster loan that has since been transferred to the Treasury. He wanted to know if there was any way to settle.

I told him that based in my experience, the bests he’s going be able to do is knock about 20% to 30% off of that (what really sucks about that is that 20% to 30% off is that it basically represents the original loan balance before the Treasury nailed you with a 28% penalty).

And even in that case, they would want to be paid in a lump sum. He simply did not have that kind of money. This is true of most people with loans at the Treasury due to their onerous demands.

We went on to discuss what options he could pursue. He could offer to make a monthly payment. My take on that is that would be like throwing money into a black hole.

When they ask you to make payments, they make no promises of any particular settlement terms in the future, which means you could be making payments indefinitely and still have them take collection action against you.

So, anyway, back to EIDL loans.

Depending on how the SBA wants to play it, EIDL loans could be that difficult to settle as well. At this point, nobody really knows.

What we do know is that in all cases, the SBA did take your business assets as collateral. This means that in theory, the SBA could replevin (which means just to take the equipment back) the equipment, sell it and apply it to your loan balance.

From a practical standpoint, I have my doubts as to whether or not the SBA will actually pursue your business assets for a couple of different reasons.

First, The SBA isn’t really set up to do that sort of thing. They don’t have the manpower. It’s a logistical hassle to arrange, to have equipment removed and auctioned.

Most banks don’t even want to deal with it. So you can imagine that the SBA isn’t particularly adept at handling this sort of thing, either.

If I had to guess, I would say most businesses that close will not hear from the SBA in terms of selling the assets. They may ask you, the business owner to sell the assets, but it’s unlikely that they’ll go out of their way to handle it themselves. That’s not a fact, that’s just my guess.

But considering that the SBA doesn’t have the manpower to simply make collection calls and follow up on delinquent loan payments (sometimes people don’t hear from them until years after they’ve stopped paying), it seems unlikely that they’ve got the manpower to come and get your pizza oven, and tables and chairs.

So getting back to your SBA EIDL loan. While we don’t know what their appetite is for settlement at this point, the situation needs to be explored.

Here are some questions that, depending on your answers, can help determine your course of action with respect to your EIDL loan:

- Did you personally guarantee your SBA EIDL Loan?

- What collateral did you pledge, and how much is it worth?

- Can you afford to repay the EIDL loan?

- Do you plan to keep the business open, or will you close it?

- Do you have other debt (SBA and non-SBA) that would need to be settled too?

If you’d like to discuss your options, you can schedule a case evaluation with me here.